Expats and locals in Australia are liable to pay the Medical levy surcharge to reduce demand on the public health services, acting as an incentive to take out comprehensive private cover for those deemed able to afford it.

Who needs to pay the MLS?

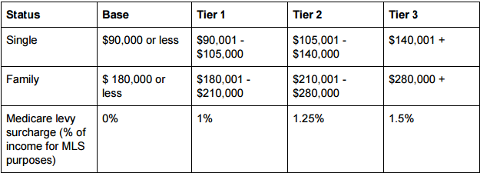

The threshold depends on your financial and personal circumstances, as shown by the table below. If your income for MLS purposes exceeds the ‘base’ level, you’ll be obligated to pay the surcharge if you don’t take out an appropriate private healthcare policy.

The amount you need to pay depends on a range of financial factors and your current status with regards to marriage and family.

How do I calculate my income for MLS purposes?

Your income for Medical levy surcharge purposes is not calculated in the same way as your taxable income. You can calculate which of the above tiers you fall in by adding and subtracting the following items.

First, work out the total of the following:

- Taxable income

- Your employer’s superannuation contributions

- Fringe benefits over $2000

- Your or your spouse’s share of net income of a taxed trust that hasn’t been included in taxable income

- Tax exempt foreign employment income

- Death benefits

Next, deduct the following:

- Personal super contributions

- Net financial investment losses

- Net rental property losses

- Any taxed part of any lump sum withdrawn from your superannuation fund by you or your registered live-in partner or spouse. This applies if you are between your preservation age and 59 years old

The final amount after adding and deducting the above determines which tier you fall into and how much you are obligated to pay for the surcharge. If you have a family, the income threshold increases by $1,500 per dependent child after the first. Family tiers also apply to couples without children and single parents.

How can I avoid the Medicare levy surcharge?

Taking out comprehensive private health cover can exempt you from having to pay the Medicare levy surcharge. Ensuring that you have the right amount of private health cover if you are over the ‘base’ income shown above means that you will be able to avoid being charged MLS. If you do have to take out a private health insurance plan to avoid the surcharge, it is worth finding a plan that gives you more - this will give you a lot more value than simply taking out a ‘junk policy’ purely to avoid the surcharge.